Listed infrastructure is an asset class that just a decade ago was poorly understood by many investors. It is now a diverse $3 trillion investment opportunity1. More and more investors are allocating to the asset class due to the differentiated return/risk characteristics we believe it offers. As infrastructure assets often have their profits guaranteed by long-term contracts or regulation, returns tend to be relatively predictable over the long term. For investors, this provides extremely good visibility for cash flows and ultimately, dividends.

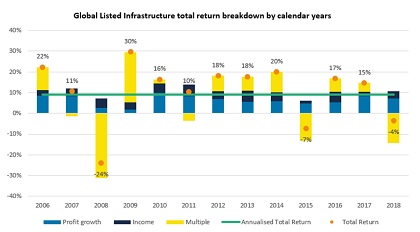

Long-term infrastructure investors should appreciate that the majority of short-term returns are driven by multiple expansion and contraction, but over the long term this has little impact. As seen in the chart below, profit growth for infrastructure companies has been consistently positive year on year. Years with negative total return have primarily been driven by multiple compression, despite positive profit growth.

Past performance is not a reliable indicator of future performance. Source: AMP Capital, Bloomberg as at 31 December 2018. Data frequency: quarterly. Data based on the AMP Capital’s Global Listed Infrastructure universe.

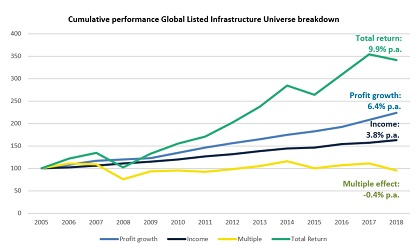

However, over the long term, the multiples effect has been neutral. We believe cash flow growth is ultimately what drives returns. This is why our investment process has a stringent focus on cash flows, compared to the more generalist investor, and short-term volatility creates opportunities for us to generate alpha for our clients.

Past performance is not a reliable indicator of future performance. Source: AMP Capital, Bloomberg as at 31 December 2018. Data frequency: quarterly. Data based on the AMP Capital’s Global Listed Infrastructure universe.

By investing in listed infrastructure, investors can access a broad set of liquid investment opportunities across geographies and sectors. However, not all infrastructure is the same. At AMP Capital, we have a strict focus on long-term cashflow stability and filter the broader infrastructure universe for the following characteristics.

|

Characteristics we look for |

Unfavourable characteristics |

|

|

As a result, we believe that most of the infrastructure opportunities lies outside of Australia, which only holds approximately two percent of the global share. North America accounts for more than half of all infrastructure assets, with a third in Europe and the remaining located in Asia Pacific and Latin America. We also categorise these assets in four main sectors: energy infrastructure, utilities, transportation and communications.

Regulatory frameworks and contract structures vary greatly from sector to sector and from region to region, as they are based on and exposed to macro variables in different ways. This highlights the importance of diversification to help mitigate risks in concentrated exposure to regional economic downturns and regulations.

The quality of core infrastructure assets on the listed market is high and there are sectors where listed companies lead private companies in terms of operational excellence. In many instances, assets are co-owned by listed infrastructure companies and direct investors. Listed infrastructure is generally considered alongside unlisted funds or buying directly into assets. Each has it benefits and drawbacks, as the table below shows.

|

|

Listed Manager |

Unlisted Fund |

Direct Asset |

|

Geographic diversity |

Very high |

Low/medium |

Low |

|

Asset diversity |

Very high |

Low/medium |

Low |

|

Liquidity |

Very high |

Low |

Low |

|

Daily valuations |

Yes |

No |

No |

|

Control |

Low |

Low to very high |

Very high |

|

Volatility of valuation |

High |

Very low |

Very low |

|

Transaction cost |

Low |

High |

High |

|

Portfolio turnover |

High |

Low |

Low |

|

Investment horizon |

Medium (~5 years) |

Long term (~10 years) |

Long term (~10 years) |

Notably the liquidity of listed infrastructure makes it accessible to a wider range of investors than the direct approach. We believe that returns between listed and unlisted assets are very similar over a full market cycle as ultimately the underlying asset, rather than the capital structure, determines returns.

Additionally, as demand for infrastructure assets have grown exponentially, we have also seen a corresponding spike in undeployed capital within unlisted infrastructure funds. While the capital flowing into the sector enables many new projects, competition for high quality assets will be fiercer and valuations will rise. Therefore, it is only natural that listed companies with access to high quality infrastructure assets and trading at attractive valuations to become potential targets for unlisted infrastructure funds under pressure to put capital to work.

These dynamics, alongside the growing numbers of investors awakening to the attractiveness of the listed infrastructure, mean that positive supply/demand drivers should add support to the strong fundamentals of high-quality infrastructure businesses.

Please contct us on 02 6947 2866 if you would like to discuss.

1 Total market capitalisation of the AMP Capital Global Listed Infrastructure Universe of over 250 stocks.

Author : Giuseppe Corona, Head of Global Listed Infrastructure, London, United Kingdom

Important notes

While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.