Urban Dictionary describes ‘Liquorice Allsorts’ as something that has many different varieties and assortments1. That to us is a perfect description of the alternative real estate sector that continues to grow in importance as investors adapt to its uniqueness. Through this piece, we take a look inside the box to see what shapes and flavours are on offer in the real estate universe.

Before we get started, let’s first take a history lesson on market evolution to date as we feel many investors are yet to implement this evolution in their real estate exposure. History shows that investors who ignore evolving trends are doomed to holding portfolios dominated by yesterday’s heroes.

The top five names of the 1980s – IBM, Exxon, General Electric, AT&T and General Motors – are nowhere to be seen at the top of the S&P500 today, replaced by the likes of Apple, Microsoft, Facebook and Google.

Investors that ignored the evolution of the economy and the rise of industries, such as Big Tech, would have been left holding companies in relative decline.

Why should it be different in real estate? It’s not.

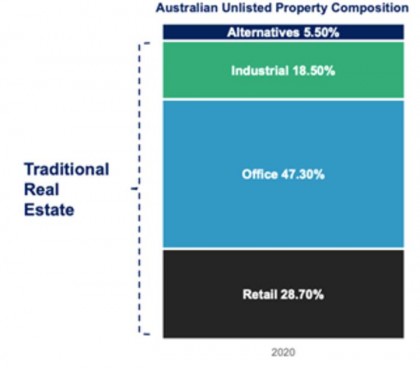

Today, Australian real estate investment is dominated by the same types of assets that have informed asset allocation decision-making in super funds for decades. Using unlisted property exposure as a proxy for institutional ownership, it’s clear that office and retail leads allocations in unlisted real estate funds among Australian institutional investors. Industrial property, (growing fast) makes up much of the rest.2

Forward-thinking investors have been recalibrating their portfolios and we believe there remains a long runway from here.

They are watching the changes that occur in the economy, in particular the evolution of technology, generational and demographics trends, and relating this to the underlying real estate demand.

Source: Real Investment Analytics. As at 31 December 2020

We believe the emerging asset class of alternative real estate will define the property industry over coming decades as both fast and slow-moving global trends, including the continued dependency on technology, advances in healthcare and an ageing population, combine to create sweeping demand shifts on the property industry.

So, what is alternative real estate? And where does it fit in an investment portfolio?

There is no universally agreed definition of alternative real estate, except that it sits in the other bucket that is not traditional real estate of office, retail and industrial.

By using the slogans of some of the biggest commercial landlords in the world and also adding our own twist, alternative real estate can be summed up by this five-word summary: beds, sheds, meds, bytes and life.

Simply put, this means the cohort comprises: 1) shelter such as build-to-rent and student housing (beds); 2) logistics including last mile – not strictly alternative but it has most certainly evolved from what the demand/supply dynamics of industrial once were (sheds); 3) healthcare, aged care and life sciences (meds); 4) data centres and telecommunications (bytes); and 5) property assets servicing changing consumer needs which are ‘everyday life’ in nature, including self-storage, agriculture and childcare (life).

To use a confectionary reference that doubles in Urban Dictionary, it’s a Liquorice Allsorts of assets but it is growing rapidly, driven by unstoppable underlying economic and societal forces.

In the US, alternative real estate assets already dominate portfolio allocations making up 55 per cent of the REIT index composition3. We believe Australia, NZ, Europe and the UK remain at the early phase of this powerful real estate evolution, with Asia not likely far behind.

Blockbuster vs Netflix

The effect of changes in the economy on real estate is illustrated by a simple, familiar story.

Not so long ago, the only way to watch a movie at home was to rent a hard copy on video tape from a local retail store.

In 2004, the US leader in movie rental was Blockbuster, a household name with more than 5,600 physical shops across the nation’s strip malls and main streets. Effectively, the retail sector had a lucrative monopoly on movie rentals.

Fast forward to today and Blockbuster has one just store remaining open globally, stubbornly clinging on as a nostalgic memory of a different time.

The difference, of course, was technology harnessed by Netflix, which started with mail order DVDs and rapidly built a market-leading streaming service. The underlying story is technology and the disruptive real estate that facilitated the change.

Datacentres and, more recently telecom towers, offer two key examples of alternative real estate assets that dominate the US listed markets.

A dormant giant

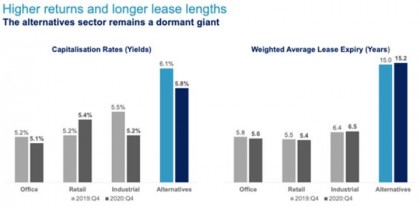

Alternative real estate might only be a small part of the property industry in Australia today but on fundamentals it looks like a dormant giant.

Real estate investment is fundamentally a question of the interplay between supply and demand along with the contractual lease terms between landlord and tenant.

Alternative real estate offers a higher yield than traditional real estate sectors, which means on average, investors are earning a greater spread over the risk-free rate.

At the same time, investors also enjoy considerably longer lease terms on average in alternatives, helping confidence in the security of cashflow.

Source: Real Investment Analytics. As at 31 December 2020

The mega trends

We believe five megatrends are driving the growth of alternative real estate.

Technology

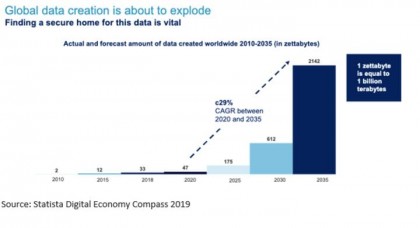

Technology, specifically data, is being referenced as the fourth industrial revolution. The growth numbers in this segment of the economy are mind blowing.

Here’s a download of some stats:

-

There will be 1 trillion devices connected to the internet by 2030

-

By 2023, mobile phone users will have downloaded 299 billion apps

-

Between 2020 and 2023, business will invest an estimated US$6.8 trillion in digital transformation.4

This digital economy creates immense economic value. Artificial intelligence and 5G networks will make up an estimated $13 trillion contribution each to the global economy by 2030 and 2035, respectively.5

But the continued growth of technology also creates another form of value – data.

Internet traffic is forecast to hit 7.2 petabytes per second at peak times by next year. To put that into perspective, that’s five times higher than 2017 and equivalent to nearly 2 million movies being uploaded and downloaded every second. 6

This data needs to be stored securely and accessible with minimal latency from somewhere and that need is fuelling the growth of data centre real estate demand.

A widely used line is “data is the oil of the 21st century” – if that’s accurate, our question is who will be the John D Rockefeller of data?

Demographics

The world is experiencing a rapidly ageing population. Dubbed the ‘Silver Tsunami’, the number of individuals aged 60 years and above will double by 2050. In the US, 10,000 people will turn 65 every day– a statistic that will hold true every day through to 2030, filling the MCG every 10 days.7

As people age, their needs change, driving demand for aged care, healthcare and hospitals and retirement living. Of particular interest in this sector is the growth of the manufactured housing sector.

Manufactured housing is a way to build retirement and lifestyle communities that offer more space and lower prices than traditional housing, specifically designed to come with community and lifestyle benefits for an ageing cohort. They are modern, low maintenance homes often in resort-style settings with swimming pools, tennis courts, bowling greens and even marina berths, all at a lower price point than a standard rental dwelling.

We believe it is one of the most exciting opportunities in alternative real estate, driven by the rising ageing population and consumers seeking alternatives to the family home at a time where traditional housing affordability is at all-time lows.

Life science

The ageing population, a renewed focus on fighting global disease and an increasingly health aware society is also driving the opportunity for alternative real estate assets in the life sciences, which aims to treat disease, extend life expectancy and improve human health outcomes.

The life science market has been at the forefront of all our minds recently as the industry races to solve the COVID-19 pandemic.

We are proud to be invested in companies that provide the space for the firms developing the most promising COVID vaccines like Pfizer, Moderna and Johnson & Johnson.

But the opportunity in life sciences will last well beyond the current pandemic. Some 10,000 diseases plague humanity, of which approximately 500 have been addressed with medical treatments.8

This creates an incredible runway of growth for the life sciences industry and underpins the real estate fundamentals of this alternative real estate asset class.

Life science has been the real estate market darling in the US for many years and is growing fast in Europe and the UK, with a growing interest here in Australia.

Food security

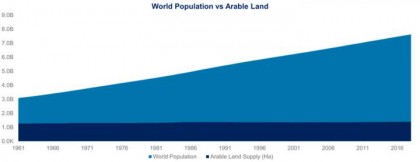

Source: Food and Agriculture Organization of the United Nations, OECD Stat. As at 30 June 2021.

Since 1961, the global population has more than doubled. Arable land, i.e. land that can be used for agricultural purposes, has remained relatively fixed, however, the water used to irrigate these lands have become scarce.9

This has significant implications for farmers as relatively fixed land supply, dearer water and a growing demand for various foods has meant a requirement to do more with less. As a result, Australian farmer productivity and efficiency has had to increase substantially to meet a hungry global economy.

Additionally, water markets have had to advance to create greater efficiencies and ensure farming operators have the water necessary to effectively irrigate their crops; the onset of the water entitlement market in Australia has supported this and means operators can buy perpetual rights to an exclusive share of a water resource they need.

A real example of these trends can be seen in the cattle industry. Meat consumption over the last 20 years has more than doubled10. Efficiencies in Australian cattle operations have had to increase substantially as a result and, because of these productivity increases, the value of agricultural land has benefited tremendously.

Farmland values have increased some 12.9 per cent over the last year and 10.6 per cent (CAGR) over the last five years11, reflecting a willingness by farmers to pay more for productive farming operations.

With its competitive advantages in operations of cattle, nuts, vineyards and other cropping areas, Australia is exceptionally well placed to take advantage of this fundamental trend, particularly as 46.6 per cent of its land area is utilised to for agricultural purposes.12

Everyday life

Alternative real estate assets are also benefiting from changes in everyday life in the western world, including rising demand for child-care and rental housing. However, we believe the standout opportunity in this space is self-storage.

The idea that households or small business might need somewhere to store their excess possessions and inventory is a relatively new phenomenon, but it is being driven by four seemingly unstoppable secular trends known as the ‘dreaded four D’s’ – death, divorce, downsizing and dislocation.

Source: Public Storage Investor Day, May 2021.

Self-storage has seen tremendous growth as a result of these trends which represent the different points in life that a person experiences personal disruption, leading many to seek alternative arrangements for their belongings. Its connection to these life events means the self-storage industry is somewhat insulated from certain economic cycles.

As an investment opportunity, self-storage also benefits from its historical fragmentation, allowing larger players to buy smaller operators at reasonable prices and improve the efficiency of returns by introducing better technology to optimise operations.

How do you use real estate today and how different is that to yesterday?

The societal and economic trends sweeping the world are a reminder of how the real estate market is evolving.

These trends impact all aspects of our lives and real estate is no different. It must grow and change in response to the needs of society.

These are exciting times for listed real estate which not only offers exposure to these underlying trends but does so in a way that offers liquidity for investors with assets that are traded on public stock markets five days a week around the world.

Alternative real estate has come to dominate REITs in the US. Will the ‘Liquorice Allsorts’ box of opportunity do the same in Australia?

1https://www.urbandictionary.com/define.php?term=Liquorice%20Allsorts

2 Real Investment Analytics. As at 31 December 2020

3 NAREIT, AMP Capital. As at June 2020.

4 Equinix Q2 2020 Investor Report, Mckinsey: Fifty Five – the quickening, NextDC AGM Presentation 2020

5 NAREIT, AMP Capital. As at June 2020.

6 Equinix, 2021

7 Ingenia Communities: Investor Presentation, United Nations, Equity Lifestyle Properties, Sun Communities (per sq. ft than other rental alternatives)

8 Alexandria Real Estate Equities – 2018 Annual Report.

9 United Nations, OECD.

10 MLA

11 Rural Funds Group

12 Australian Bureau of Statistics

Author: James Maydew, BSc (Hons), MRICS Head of Global Listed Real Estate Sydney, Australia

Source: AMP Capital 30 July 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMPCFM) is the responsible entity of the AMP Capital Australian Equity Income Fund, known as the AMP Capital Equity Income Generator (Equity Income Generator) and the issuer of the units in the Equity Income Generator. To invest in the Fund, investors will need to obtain the current Product Disclosure Statement (PDS) from AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232 497) (AMP Capital). The PDS contains important information about investing in the Fund and it is important that investors read the PDS before making a decision about whether to acquire, or continue to hold or dispose of units in the Fund. Neither AMP Capital, AMPCFM nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Information, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to their objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

Distributions for AMP Capital Equity Income Generator are preannounced six months in advance. Distributions for the AMP Capital Income Generator may be preannounced six or twelve months in advance. It is important to note that the final annualised distribution yield will not be known until the end of the financial year, that the distribution yield estimate is not guaranteed, and that it may change due to market conditions.

Estimated Distributions Assumptions: The estimate is based on the amount of income we expect to receive into the fund over the period from 31 December 2015 to 30 June 2016, based on the current investments held by the Fund, the level of dividends and franking credits expected to be earned from investments held in the Fund. If the companies whose securities we hold in the fund do not pay the dividends or franking credits they have forecast, or if the Fund portfolio changes materially over the period, this may impact our estimated distribution amount.