Australia’s resurgence from the depths of the COVID-19 has been impressive by any measure. In the second half of 2020 we chalked up two consecutive quarters of GDP growth in excess of 3%1 – the first time this has been accomplished in recorded history, according to Treasurer Josh Frydenberg2 – and although growth through 2021 has been more modest, to this point we believe it shows no sign of stalling. GDP, employment and the ASX 200 share market index have now all surpassed their pre-COVID highs3.

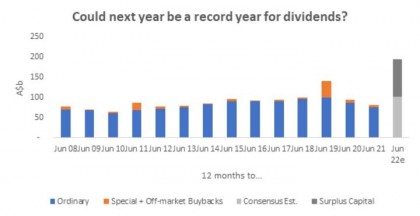

While stimulus and re-openings fuelled the recovery through the tail end of 2021, what we’re seeing now is a triple boom in mining, housing and corporate profitability. With GDP growth for the year likely to be in the order of 5%4, iron ore above $200 per tonne and the RBA over-stimulating an overheating property market, the stage is set for potentially record operating cashflows and dividends.

But payouts won’t necessarily be consistent or evenly distributed, and there are a number of events unfolding that to which we think investors should be paying close attention.

click to enlarge

Source: FactSet, AMP Capital- Past performance is not a reliable indicator of future performance.

Short-term windfalls in banks and mining

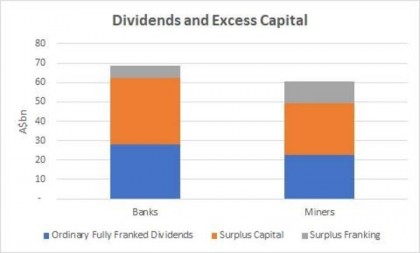

Thanks to the robustness of the housing market, and with the risks of the pandemic receding into the rear-view, we expect banks will start releasing provisions – funds held over in case of a COVID-related housing crash during 2021 – back to shareholders. At the same time, record iron prices are pumping up profitability in the resources sector, meaning that in our opinion the ‘big four’ banks and the top three miners, the behemoths of Australian income stocks, are all poised to deliver massive dividends. These two sectors alone have the potential to return over $50 billion each to investors over the next financial year, under an optimal scenario, equal to the previous record annual distribution haul for the whole market5.

Investors should consider opportunities around this historic market event, but with an eye to the temporary nature of some of the factors behind it.

click to enlarge

Source: FactSet, AMP Capital- Past performance is not a reliable indicator of future performance.

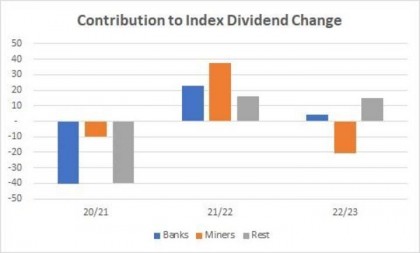

Broad mid-cycle strength offers sustained value

Across the rest of the Australian share market, a continued upturn in profitability is expected to continue for more than 55% of stocks, which are still below pre-COVID dividends6. As long as current favourable business conditions- such as low interest rates- continue to hold, increases in earnings across these stocks should be sustainable and this may lead to re-rating as the market becomes more comfortable with the outlook for cashflows and future dividends. In other words, mid-cycle strength from those stocks which lagged the market in February dividends could prove to be a happy hunting ground for income investors through the remainder of the year.

click to enlarge

Source: FactSet, AMP Capital- Past performance is not a reliable indicator of future performance.

We believe some of the best opportunities are likely to be found in areas such as healthcare (benefiting not only from pandemic-specific demand but also from a backlog of procedures deferred in the interim), domestic retail (buoyed by latent demand and continued restrictions on international travel) and those companies with exposure to the housing boom, such as trades and materials suppliers.

The main potential threat to continued improvement in profitability across the market seems at this point to be a breakout in inflation. High rates of spending have led to record employment7, which has the potential to drive up prices in classic early-cycle overheating. If the RBA is true to its word and holds rates down, we should expect to see a move to positive CPI and PPI, which hasn’t occurred globally for some time8. Here in Australia, the closest comparison is probably the inflation that accompanied the 2006 boom, which was stifled aggressively by the RBA. We’re in a very different climate now, and the RBA is unlikely to follow that course of action unless there was a significant and sustained breakout in inflation. We believe this is good news for income investors looking to capitalise on what we think are some of the healthiest dividend conditions in the history of the Australian market.

1. Australian Bureau of Statistics (ABS). As at 31 December, 2020.

2. https://www.theguardian.com/business/2021/mar/03/australias economic recovery continues with 31 growth in december quarter

3. ABS. As at 16 June 2021.

4. https://www.amp.com.au/insights/grow-my-wealth/olivers insight the australian economic recovery remained strong in the march quarter with gdp up 1 8 seven reasons for optimism

5. AMP Capital, FactSet. As at 16 June, 2021.

6. AMP Capital

7. ABS. As at 31 May 2021.

8. Reserve Bank of Australia, Minutes of the Monetary Policy Meeting of the Reserve Bank Board, June 2021); https://www.rba.gov.au/monetary-policy/rba board minutes/2021/2021 06 01.html

Author: Dermot Ryan, Co-Portfolio Manager (Income)Sydney, Australia

Source: AMP Capital 18 June 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.